The amount by which consumer surplus is reduced by the imposition of an indirect tax. However, the elasticity of the demand curve affects how much of the tax is passed onto consumers.

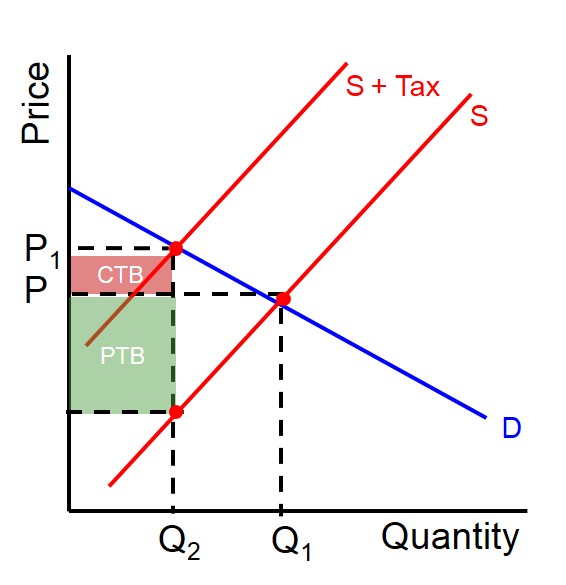

Below is a diagram to illustrate how the imposition of an indirect tax implaces a burden on consumers. In this instance the demand curve is neither inelastic or elastic and therefore the tax burden is split evenly between the consumers and producers.

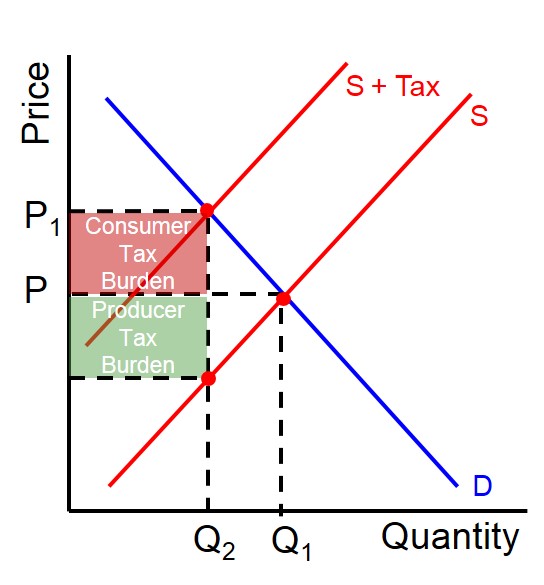

Below is a diagram to illustrate when the demand curve is inelastic and therefore the tax burden is split unevenly towards consumers ahead of producers.

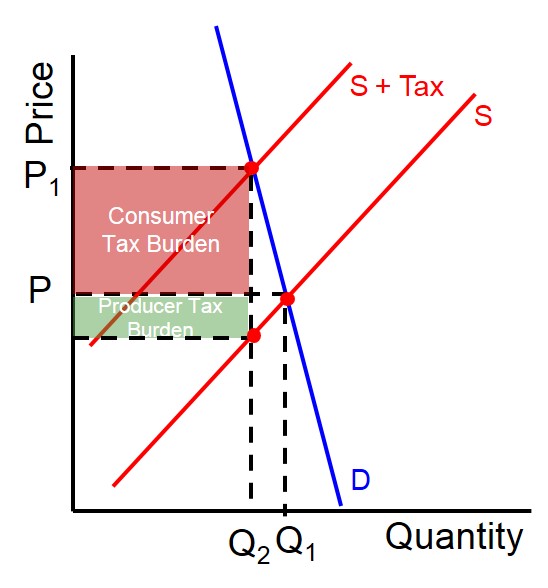

Below is a diagram to illustrate when the demand curve is elastic and therefore the tax burden on consumers is small.