The expenditure undertaken by government to provide things like transfer payments, public services and infrastructure.

In the context of measuring Aggregate Demand any expenditure relating to transfer payments is excluded.

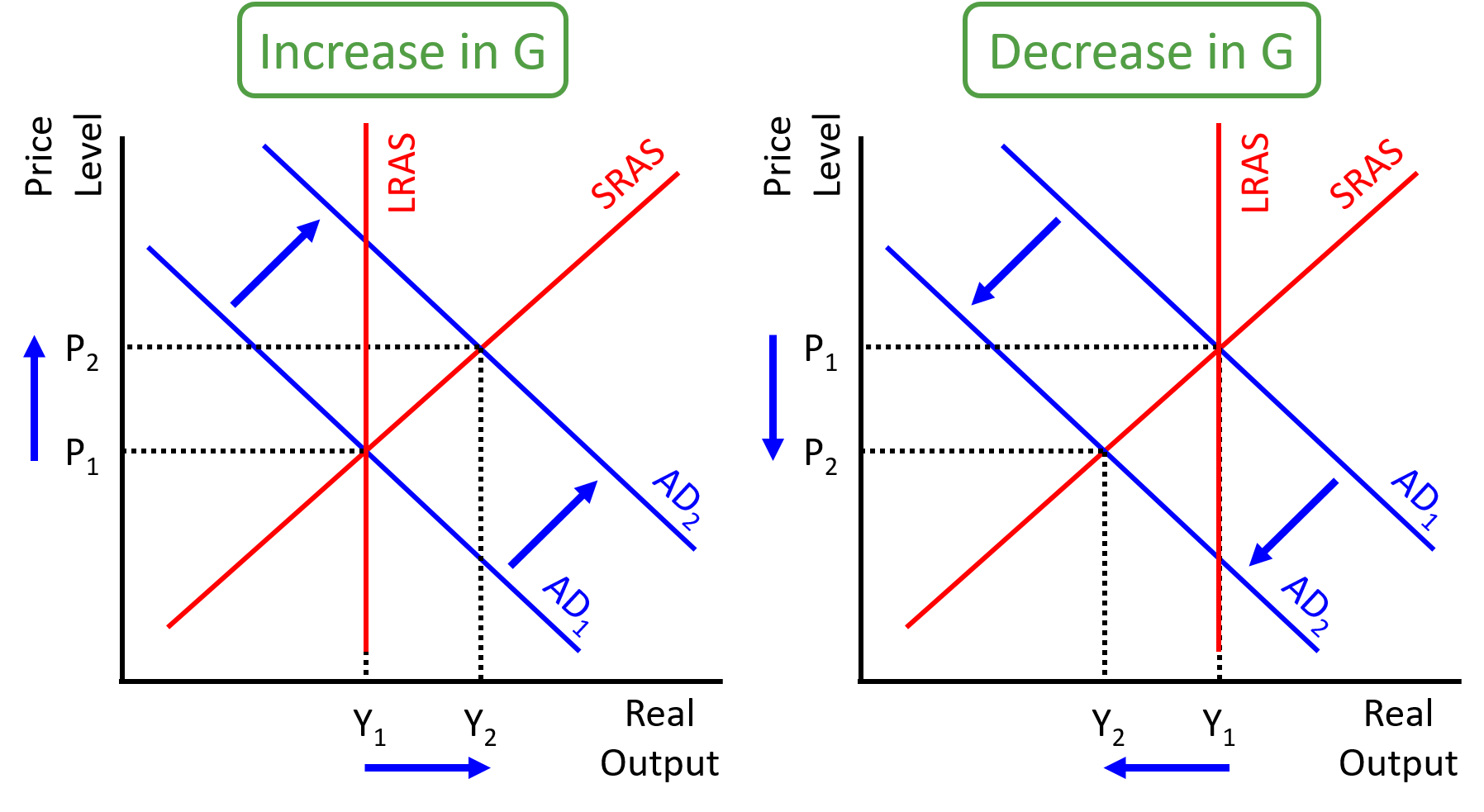

Government spending is one of the key macroeconomic policy levers available to a government to control the business cycle. Increases in government spending cause an expansion in aggregate demand and decreases in government spending cause a reduction in aggregate demand.

An increase in government spending can be funded via raising taxes across the economy and/or borrowing more by selling government bonds. The decision of how the government funds the extra spending depends on the political environment, cost of borrowing and the overall health of the economy. For instance, if the cost of borrowing (i.e. bond yields) are high then the government may decide this is not a good time to borrow to invest in public infrastructure. This is because the returns generated will struggle to exceed the initial borrowing costs and interest charges. However, it may be the case that the government operates in a low growth economy and imposing heavier taxes on economic agents, could create significant long-term damage to the economy and therefore it is not feasible to raise spending by taxes and higher borrowing may be the only option.

Keynesian economists argue that governments should be active in using government spending to impact the economy, in particular encouraging an increase in government spending during recessions. Classical economists are more wary of having too much government spending due to its potential effects to cause or increase a budget deficit.