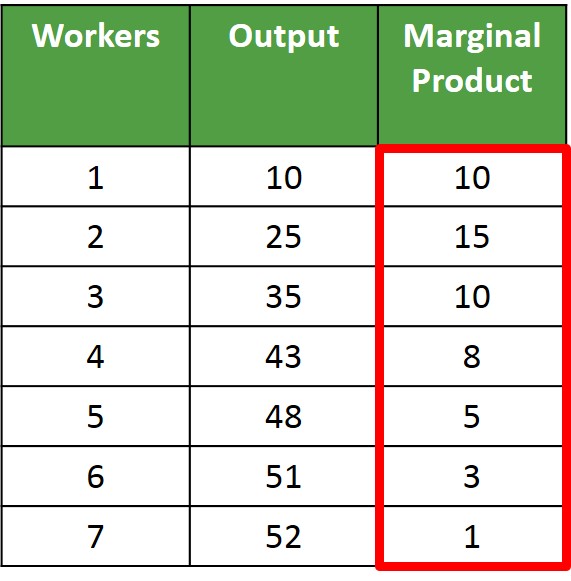

A firm in the short-run will eventually experience diminishing marginal returns i.e. as the firm keeps on adding a flexible factor (labour), the amount the additional resource can produce decreases.

Below is an example of how the law of diminishing marginal returns can be illustrated both graphically and numerically. The marginal product is positive for each additional worker, which emphasises that each worker is contributing to the level of output for the firm. But this marginal product starts increasing at a decreasing rate after worker 2. This does not mean that any workers employed after worker 2 is less productive and less efficient but just that the conditions in the workplace for this firm to absorb extra workers without additional capital and infrastructure is restricting the amount of output future workers can make. For instance, if a bakery shop keeps employing new bakers without increasing the number of ovens available for bakers to use will mean that the value of each additional baker hired in terms of output will be lower, as each of the bakers are having to queue up to use each of the ovens.

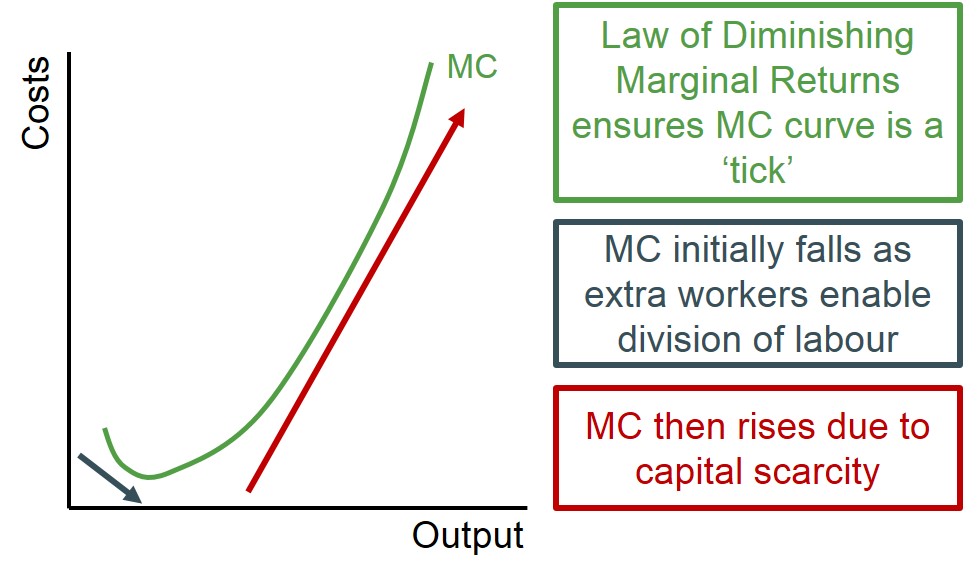

Therefore, given that this law exists this causes the marginal cost curve to have the shape that it has below. This is because the marginal product is rising for the first extra workers hired and therefore the marginal cost is low. But as the marginal product belonging to each worker begins to fall the marginal cost begins to rise as the firm moves closer and closer towards full capacity.