If a country experiences a differential absolute advantage in both goods this generates a difference in the opportunity cost of production and provides incentives for both countries to specialise and trade.

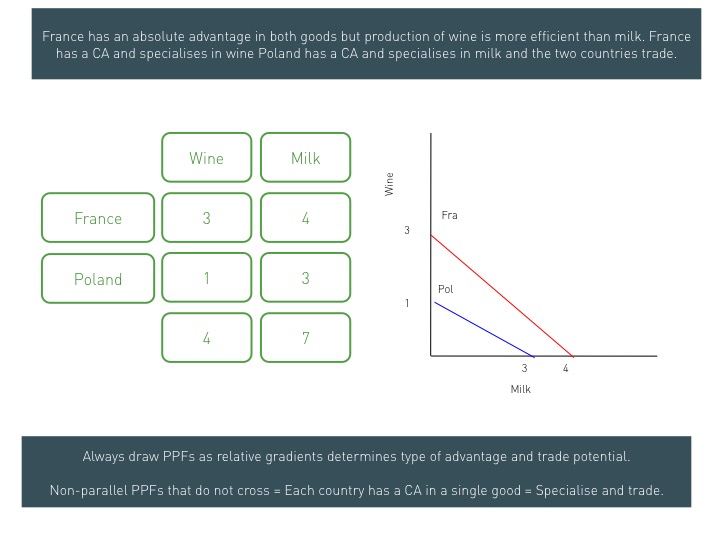

The following example demonstrates how although France has an absolute advantage in the production of both goods it does not benefit from a comparative advantage in the production of both goods. France has a comparative advantage in wine but not in milk as Poland has a comparative advantage in this product. This will become clear by calculating the opportunity cost of producing each good for each of the two countries.

The opportunity cost = production gained /production lost. For example, if a country divides resources evenly between two goods and makes 3 wine and 4 milk it can make another 3 wine if it gives up 4 milk. So production gained is 3 wine / production lost is 4 milk. This means that the opportunity cost of producing 1 extra wine is 1.33 milk (i.e. 3/4). The table shows that France has the lowest wine opportunity cost and Poland has the lowest milk opportunity cost. France specialises in wine and Poland in milk.

If you find the calculations are challenging it is sometimes easier to start by drawing PPFs which are non parallel but do not intersect (see below). A Some students may find it easier to draw the graph and then analyse the relationship between PPFs to determine comparative advantages:

- The most efficient country (PPF furthest from origin = France) has a comp advantage in the good exhibiting the LARGEST difference in production i.e. the good plotted on the axis where the difference between the 2 PPFs is LARGEST = wine.

- The least efficient country (PPF closest to the origin = Poland) has a comp advantage in the good exhibiting the SMALLEST difference in production i.e. the good plotted on the axis where the difference between the two PPFs is SMALLEST = milk.