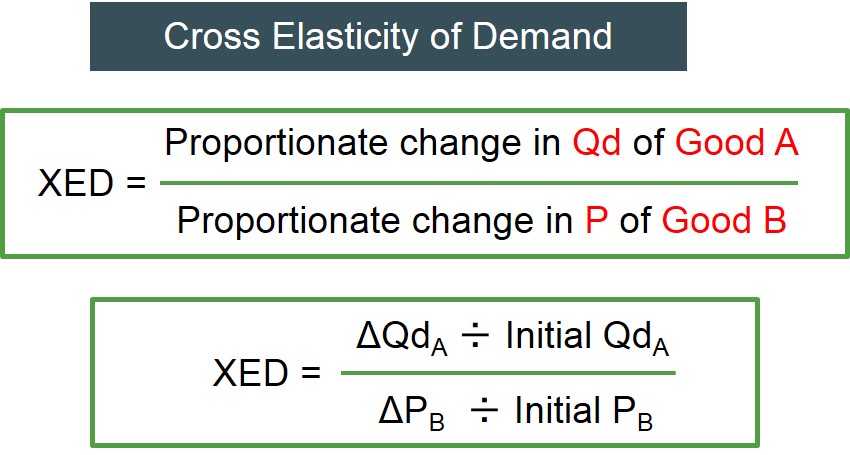

The proportionate change in the quantity demanded of a good in response to a proportionate change in the price of another good.

The formula for this is given below:

If the XED value is positive, the two goods in question can be classed as substitutes as the rise in the price of one good leads to a rise in the quantity of the other good. As consumers switch away from consuming the higher priced good and buy the other good instead e.g. Pepsi and Coke. If the XED value exceeds 1 this indicates that the two goods in question are close substitutes i.e. as the price of Good B rises by 1% then the quantity demanded of Good B will rise by more than 1%. The closer the substitutability between products the greater the positive XED value becomes.

If the XED value is negative, the two goods in question can be classed as compliments as the rise in the price of one good leads to a fall in the quantity of the other good. This is because as the goods are goods which should be consumed together, if one becomes more expensive consumers will stop buying both goods e.g. pasta and pasta sauce. If the XED value lies below -1, the goods in question are very complimentary and therefore the quantity demanded of Good A will respond sensitively to the price of Good B.

Cross elasticity of demand can be used to show the relationship between related goods and can provide useful information for firms that are competing in markets with a high level of interdependence.