A persistent fall in the price level within an economy over a period of time, resulting in the inflation rate falling below 0% (negative inflation). As a result, this causes the value of money in the economy to rise, as each unit of currency now buys more units of goods and services. There are many real world cases of deflation as very rarely does a country experience a negative inflation rate (falling price level over time).

However, it is important to make the distinction between a falling inflation rate and deflation. If a country has a falling inflation rate this is classed as disinflation as it is an example of an inflation rate that is rising at a slower rate than before - this is because inflation always concerns rising prices. Only when the inflation rate becomes negative can it be classed as deflation - as technically at this point the general price level is falling from one period to the next.

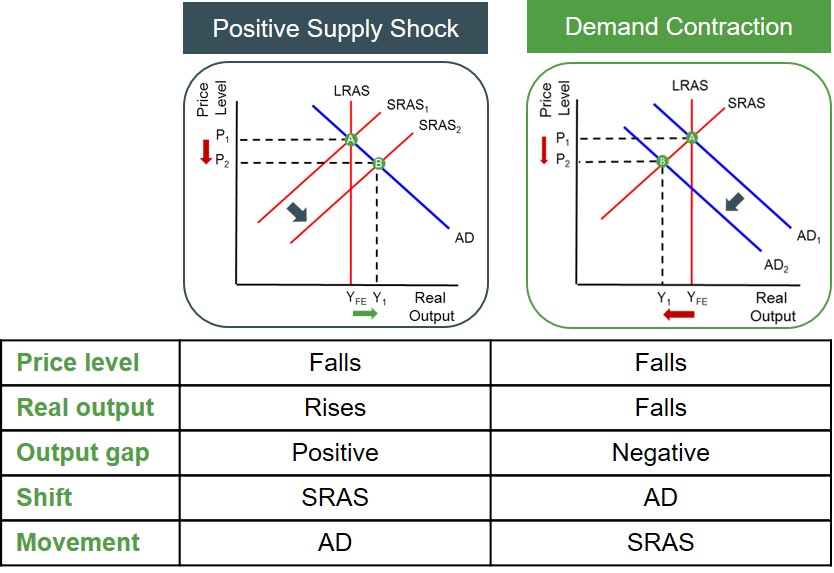

Deflation can be created by two separate factors:

- Supply Side Improvements - Positive supply curve shift (SRAS shift in short-run, LRAS shift in the long-run).

- Decrease in Economic Activity - Inward Aggregate Demand curve shift

These two causes ultimately create pressure for prices in the economy to fall over time, as a result of a deflationary output gap being created.

Despite the price level falling in both cases, the wider impacts on the economy vary depending on which curve has shifted. For instance, under a demand curve contraction it not only causes the price level to fall but real output and employment move the same way too. The long-run impact of this could be that business confidence and profits are hit and may cause firms to stop investing which contracts the AD curve even further, resulting in an even more significant price level fall. The positive supply side shock does not create these systemic problems in the economy and if accompanied with a LRAS curve shift could lead to the capacity of the economy to expand. This is why quite often the positive supply side shock is referred to as 'good deflation' whilst the AD contraction is referred to as 'bad deflation.

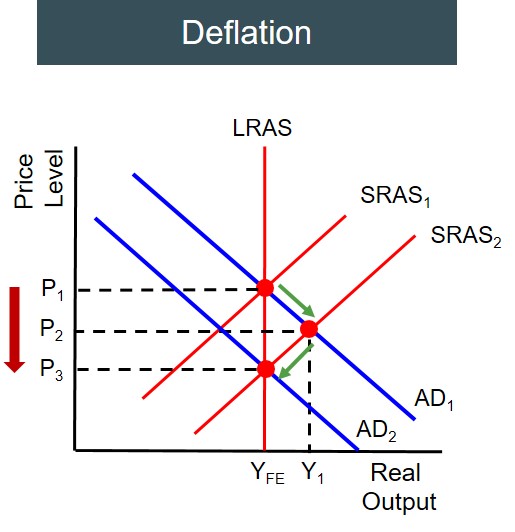

However, often it is common for both factors to play their part in a country being caught in a deflationary spiral. If prices fall significantly from P1 to P2 via a positive supply side shock, then this causes consumers to delay their purchases, in anticipation of further price falls in the future. Doing so, causes the level of economic activity to fall and this causes the aggregate demand curve to contract in response to that. This causes the price level to fall even further to P3. Suddenly the economy has been plunged into a deflationary spiral. This is shown in the diagram below:

This is called a deflationary spiral as the cycle of falling prices continues for potentially a very long time i.e. deflation in Japan. This is because firms realise that consumers are delaying spending until prices fall, so therefore they have to cut prices in order to gain some revenue. But doing so, reduces their margins and this causes investment levels from firms to fall which can reduce the AD curve and price level to fall even further.

Deflation is often seen as a sign of a fragile economy as domestic economic activity wains, creating problems such as:

- Deferred consumption

- Damages consumer and business confidence

- Lower business profits and investment

- Increase in the debt burden (increase in real cost of borrowing)

- Increased probability of loan defaults

- Damages economic growth

However, when evaluating the impact of deflation on the macroeconomic performance of an economy it all depends on weighing up the short-run benefits of lower prices for goods against the long-run costs of a consistently falling price level. This is because deflation is not necessarily a problem in an economy, as long as it is only temporary, as consumers enjoy the short-term boost of lower prices and firms enjoy the higher quantity of sales despite the fall in prices. But if sustained for a longer period of time then this introduces deferred consumption and this is where the margins and profits of firms starts to become significantly affected.

The main evaluation points when considering the impact of deflation on an economy are as follows:

- Extent of Deflation (e.g. size of curve shift)

- Duration of Deflation (e.g. short-term or long-term effects)

- Scale of Deflation (e.g. national or worldwide scale)

- Impact on Competitiveness (e.g. relative inflation rate)

- Impact on Economic Agents (e.g. confidence, investment, profit and consumption)

- Possible Policy Response (e.g. effectiveness of policies)