When the demand for one good or service results in the demand for another good or service that is a necessary part of the production process.

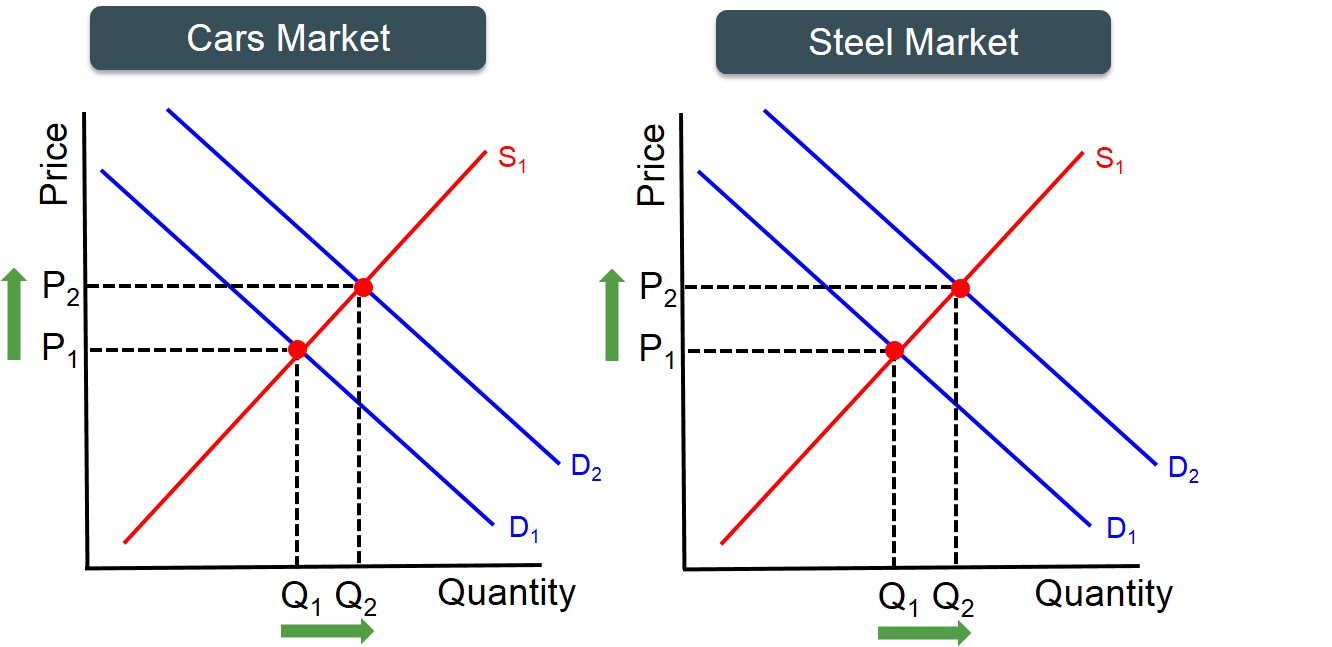

Below is a set of diagrams to illustrate derived demand in a demand and supply framework. If there is an increase in demand for cars, then ultimately more cars need to be produced to meet the extra demand. However, more cars can only be made if more steel is made. So therefore similtaneously an increase in demand for cars will lead to an increase in demand for steel, as steel has demand derived from cars.