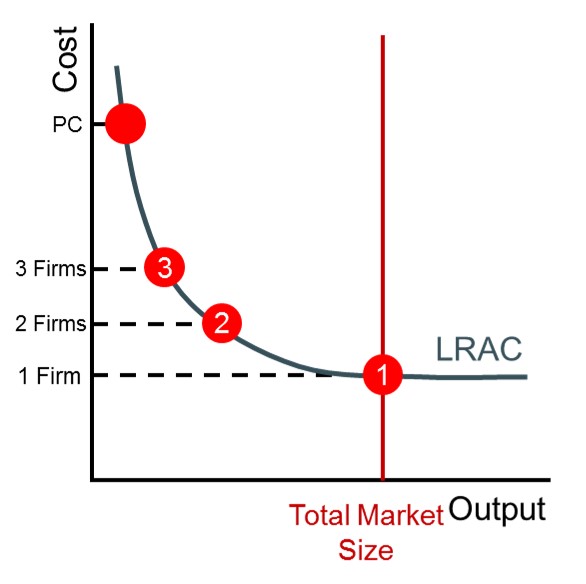

A market where there is only room for one firm to operate due to substantial capital requirements or 100% ownership of a key resource. There are very few remaining examples in the UK due to the break up and privatisation of state monopolies since WW2. It an also be graphically represented by the minimum efficient scale being large relative to the size of the market and therefore only one firm to be able to reach the MES.

Below is a diagram to show how a natural monopoly rises in a market. In this instance only one firm is able to reach the MES point to fully exploit all the economies of scale in the market. To break up this natural monopoly, more competition needs to be added. But with that extra competition comes higher average costs, reduced average costs and as a result higher prices for consumers as the diagram shows. So in many cases a natural monopoly is often beneficial for a market from both consumers and producers point of view.