Highlights the extent of how far away an economy or firm is from producing at its maximum feasible production level. The spare capacity refers to resources which are not being fully utilised in the production processes of firms and this explains why output lies below the maximum level.

If an individual firm has spare capacity this means the factors of production (labour, land, capital and enterprise) are not being used in the most efficient way and this reduces the ability of firms to produce at their maximum level. The implications of firms having a significant level of spare capacity is that they are likely to face an inelastic supply curve i.e. restricted in their ability to increase production when prices rise. This inelastic supply will then go on to impact the firms profitability.

From an economy's perspective, if spare capacity exists this relates to the total economy's endowment of resources not being fully utilised in the most efficient way possible. As a result the firm is producing at a level below its productive capacity and is classed as productively inefficient.

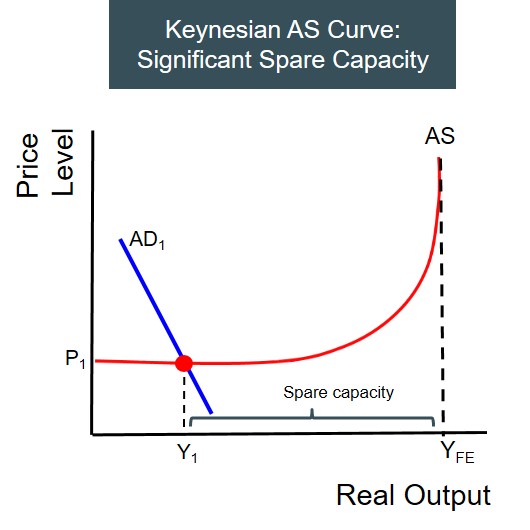

The cleanest way to evaluate spare capacity in the economy is to use the Keynesian aggregate supply curve. As this curve shows that the AS curve for an economy is upwardly sloping. It shows as the economy moves closer to full employment the AS curve becomes more inelastic. This means the impact of aggregate demand curve shifts on the inflation rate becomes amplified the less spare capacity the economy has, because the increased demand cannot be absorbed by spare resources. The evaluative point here is that the more spare capacity an economy has the less of an impact AD curve shifts have on the inflation rate.

Below is a depiction of the Keynesian AS curve for an economy that is positioned at a point with significant spare capacity.