Automatic fiscal effects which help influence the path of economic growth due to cyclical changes in tax revenue and welfare costs. Often the presence of fiscal stabilisers reduces the effectiveness of a fiscal policy.

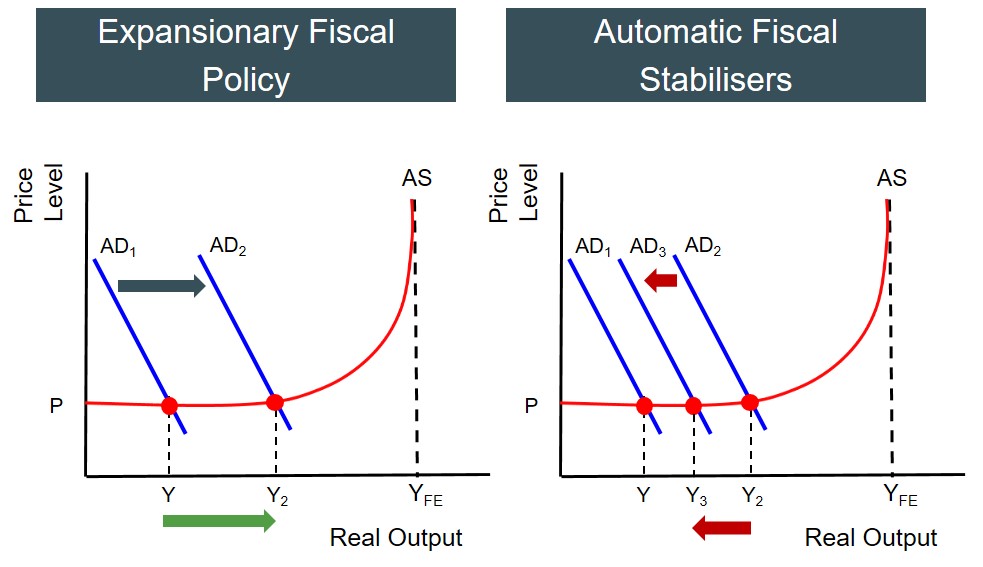

For instance, if the government runs an expansionary fiscal policy, this should theoretically increase aggregate demand quite significantly as a result of the government spending component of AD increasing or higher consumption brought on by higher disposable income (Y-T). But taking into account the role of automatic fiscal stabilisers, the expansion in AD (upside in growth of output, employment and the price level) from this type of fiscal policy will be constrained and the aggregate demand curve shift may not be as significant i.e. shifts to AD3 rather than AD2.

This happens because if real output increases, then this will lead to more people in employment and the individuals who were already in employment might secure higher wages. As a result the level of tax revenue the government now receives will be higher. At the same time the spending on welfare benefits will fall as more people enter employment. On a positive note this improves the financial position of the government (budget deficit could improve) but it also acts as a limit on the upturn seen in the economy.

It is also important to note that this significantly impacts the multiplier effect as well. As the impact of a positive multiplier, in reaction to an expansionary fiscal policy, may well become diluted by the operation of automatic stabilisers. The greater the multiplier effect, the greater the restraint automatic stabilisers place on the upturn in the economy.

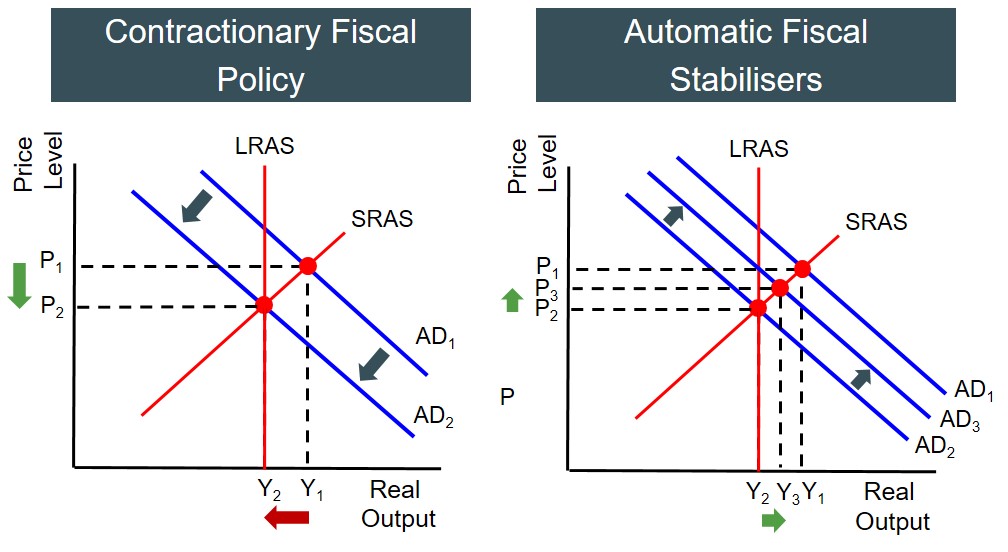

On the other hand, if the government runs a contractionary fiscal policy, this should theoretically decrease aggregate demand quite significantly as a result of the government spending component of AD decreasing or lower consumption brought on by lower disposable income (Y-T). But taking into account the role of automatic fiscal stabilisers, the contraction in AD (downside in reduction of output, employment and the price level) from this type of fiscal policy will be constrained and the aggregate demand curve shift may not be as significant i.e. shifts to AD3 rather than AD2.

This happens because if real output decreases, then this will lead to fewer people in employment and the individuals who remain employed in employment might be on lower wages or have a general insecurity about their job safety. As a result the level of tax revenue the government now receives will be lower. At the same time the spending on welfare benefits will rise as more people become unemployed. From the government's perspective, this has a negative impact on their fiscal finances (the reduction n the budget deficit may not be as large as anticipated.) but it does act as a limit on the downturn seen in the economy.

It is also important to note that this significantly impacts the multiplier effect as well. As the impact of a negative multiplier, in reaction to a contractionary fiscal policy, may well become diluted by the operation of automatic stabilisers. The greater the multiplier effect, the greater the restraint automatic stabilisers place on the downturn in the economy.