When the Government implements policies that fail to maintain steady growth and instead it achieves periods of rapid growth (boom) followed by decline (bust).

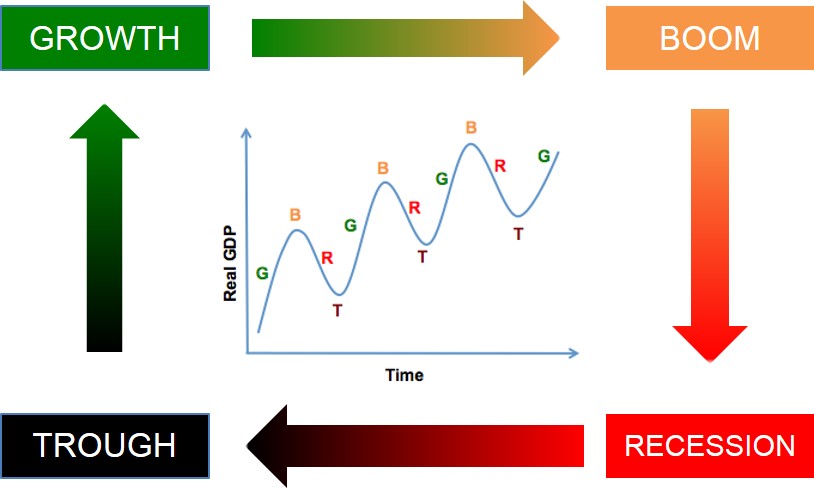

In normal cycles of economic activity an upturn leads to a boom followed by a downturn in which a recession leads to a trough which indicates the economy has gone bust. This description is used because low levels of economic growth will usually mean that tax revenues fall, government spending rises and the government is forced to borrow money to cover the shortfall in its finances. In extreme cases a sustained downturn may mean that a government is not able to borrow money from financial markets and will need to seek a bailout from organisations such as the IMF.

Although the real economy's economic cycle does not operate as smoothly as depicted in the graph, the general pattern seen is similar. The depth and duration of the different cycle phases will largely depend on the effectiveness of fiscal and monetary policies implemented by the government and central bank. Government's are not always prepared to pursue the fiscal and monetary policy that is necessary to control economic cycles. This is often the cause of extreme and prolonged downturns and the need to obtain bailout funding.