A scheme established and funded by the Government to control prices in key markets (e.g. soft commodities). The scheme works by actively buying and selling the goods produced in the market, so that market prices are stabilised.

This policy is used in markets that suffer from volatile prices. Therefore, it is a commonly used policy in agricultural markets as these markets are subject to large seasonal fluctuations involved in producing the agricultural products, which readily impact supply and demand and ultimately cause the prices to fluctuate. When prices for agricultural products fluctuate, then so do the incomes of the farmers harvesting these products. This can have wider implications for the economy because if farmers income progressively deteriorates, then it could lead to investment in capital in the agricultural market to fall and ultimately this will reduce crop yields, as well as productivity and efficiency in this market. This is a particular problem for developing countries, as their economies rely heavily on the success of agricultural exports.

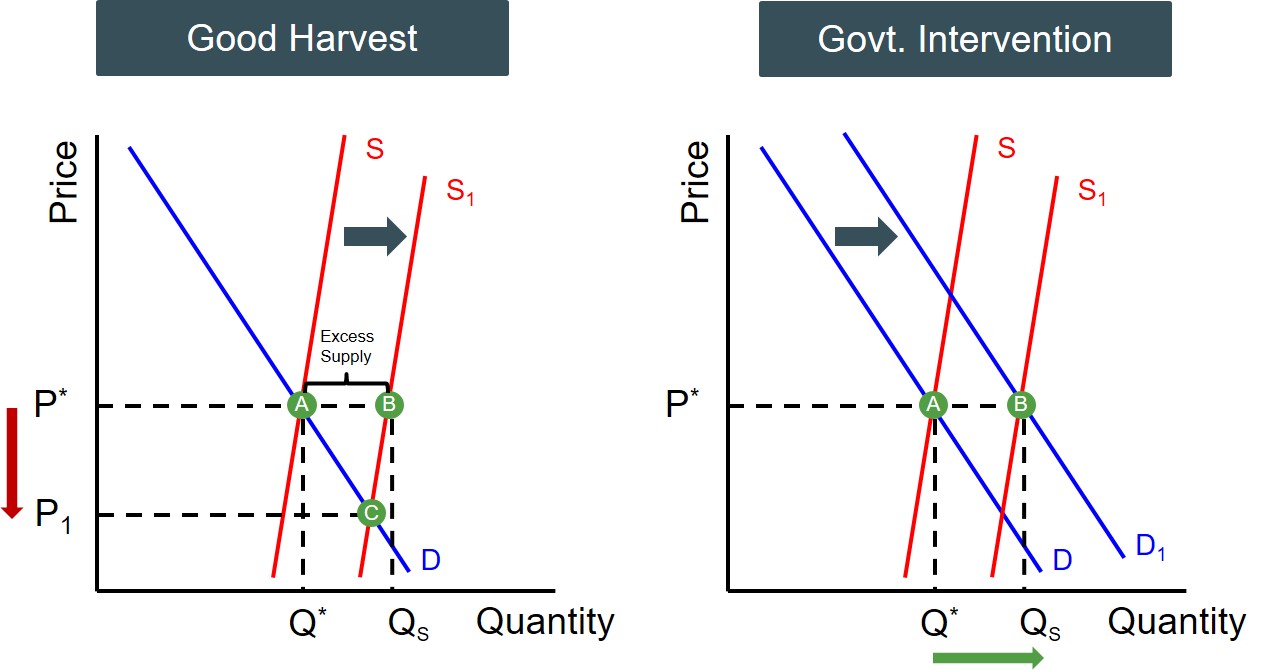

A buffer stock is a cyclical scheme in which surplus stock is effectively recycled to the consumers to prevent the waste of resources. The cycle starts when farmers have a good harvest (e.g. down to favourable weather) and this leads to supply being higher than anticipated and the supply curve outwardly shifts to S1. Assuming ceteris paribus, this creates excess supply in the market, creating downward pressure on the price of crops to change to P1. So to prevent the price from falling, the government intervenes and buys up the surplus of (QS - Q*) at the original higher price, shifting the demand curve to D2, protecting farmers margins and income in the process.

The next phase is the decision of what the government decide to do with the excess stock they have now acquired from the farmers. Now in this instance agricultural products are perishable (quality diminishes very quickly) goods and therefore the government cannot hold this stock for a long period of time, as the product will be worthless to any consumer. At the same time they do not want to dispose of the surplus stock as that would be a waste of the economy's resources. Therefore, they are required to keep this surplus in storage. But by doing so can create the government a whole lot of problems, as storing resources is a very expensive process and involves a high opportunity cost. Also, placing surplus stock into storage is subject to spatial and technical requirements, as some goods require to be stored in a technical way such as refrigerating certain agricultural products. Particularly for developing countries, they may not have the capital and technology to store these goods effectively.

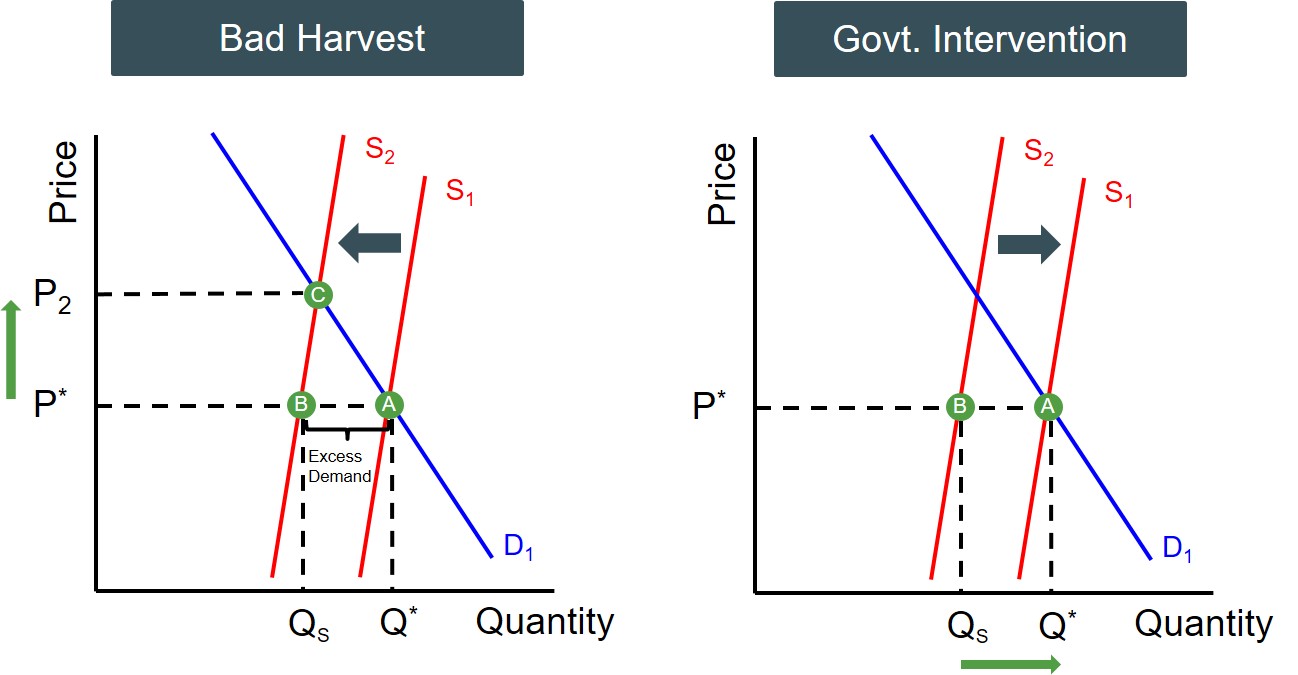

If the government has the capability to store the surplus stocks effectively then this stock gets resold to the farmers during a bad harvest when supply is short and the supply curve shifts to S2. This is because without farmers being resold the surplus stock there would be excess demand in the market equal to (Q* - QS) and this creates upward pressure on prices to change to P2. The extra stock sold to farmers shifts the supply curve back to its original position (S1) and restores stability to the price of this product. The severity of the bad harvest depends on how much stock the government decides to sell back.

However, one of the main issues with a buffer stock scheme is that often there are consecutively bad harvests for farmers to cope with, which means the scheme breaks down as a result of the government's surplus stock becoming exhausted. If this happens, it returns the market to a situation of volatile prices and incomes.

Another issue with this policy is it can create moral hazard problems with farmers and as a result reduces the efficiency of the market. For instance, if farmers know that whenever prices fluctuate the government will intervene to stabilise them, then there is no incentive from the farmers perspective to become more efficient and invest and innovate into the production process of the products. Therefore, the policy has effectively encouraged inefficiency by a offering a guaranteed price to farmers under all circumstances.