Prices rise in a steady and consistent manner without ever rising rapidly. This is the target of most economies as a consistent and modest rate of inflation encourages consumption and investment.

It is important when evaluating the inflation rate in an economy, to judge how quickly the inflation rate is rising. This is because the impact on economic agents from inflation depends on the type of inflation in the economy

- Rising and volatile inflation is bad for the economy as it creates uncertainty and reduces confidence, consumption and investment

- Modest, steady and consistent inflation creates macroeconomic stability and encourages economic activity such as consumption.

- Low and falling inflation raises fears over deflation and this discourages economic activity as economic agents await further price falls.

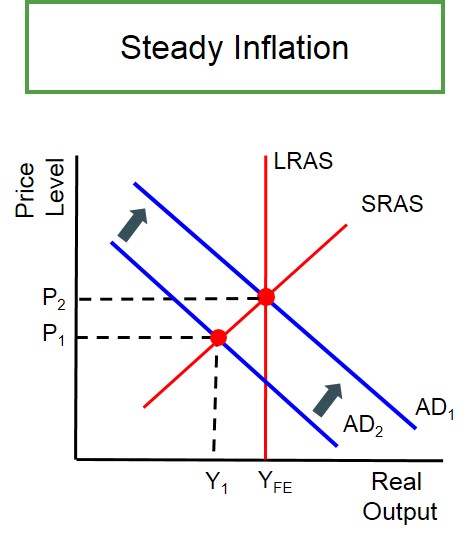

Below is a diagram to depict controlled and steady inflation in an economy. In this situation the economy is below full employment and therefore has a significant amount of spare capacity available. This means a positive aggregate demand curve shift does not raise concerns about the inflation rate as a result of the economy being below full employment. This type of inflation is not damaging and this highlights the role of the MPC to ensure that this type of steady inflation is met and it does not escalate to runaway inflation.

In an exam if you are evaluating inflation rate increases, the position of the economy (level of spare capacity available) will affect how the inflation rate increase is perceived in the wider economy.