A payment made by governments to suppliers to encourage the supply of particular goods. This is common in agricultural markets and goods with environmental benefits.

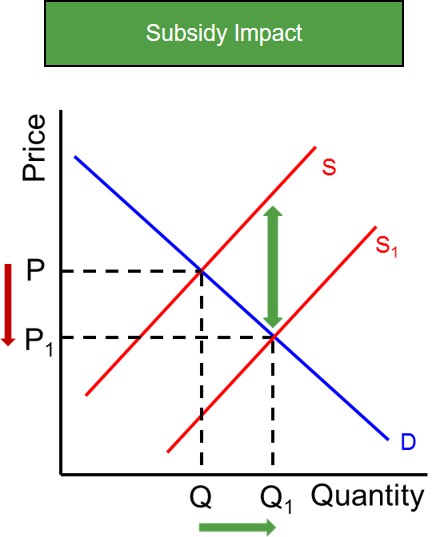

Below is a diagram to illustrate the impact of a subsidy being given to farmers in the potato market. In this instance, the subsidy encourages producers to produce more goods causing the supply curve to outwardly shift to S1. This is because the costs of production have effectively fallen, as the subsidy provider (government) has paid part of the cost of production. The impact this has on the market is that it encourages producers to produce more of the good they are producing, shifting the supply curve to S1. This creates excess supply in the market and puts pressure on the price to fall in order for the market to clear (as the demand curve has remained unchanged) and this causes the amount of goods sold to increase as the lower price fuels higher demand.

Subsidies are used predominantly by the government to reduce or remove externalities (dead weight loss triangle) that exist because of under-consumption and under-provision of a good i.e. positive consumption externalities, positive production externalities and merit goods.

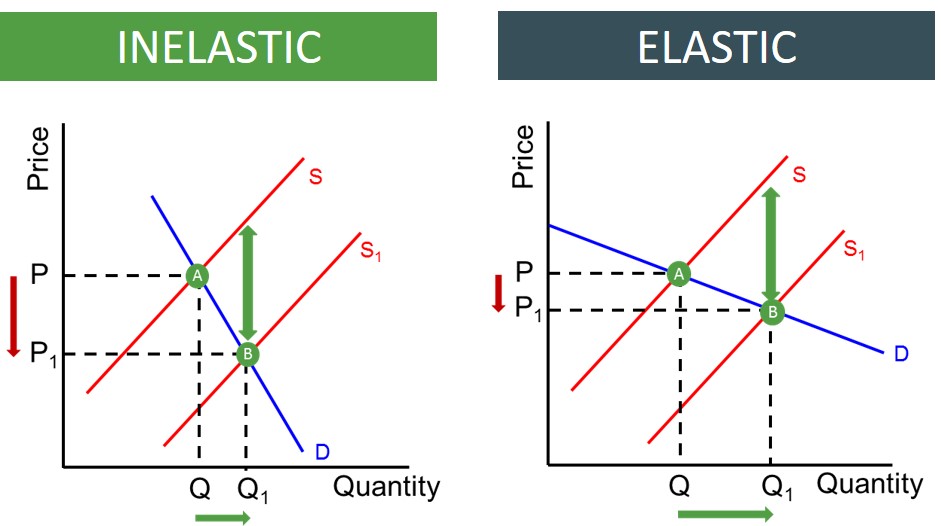

However, when evaluating the effectiveness of subsidies it is important to take into account the price elasticity of demand. The more inelastic the demand curve the greater the price fall in the market. Where as with an elastic demand curve, the price fall is smaller as producers do not pass a large percentage of the subsidy onto consumers.

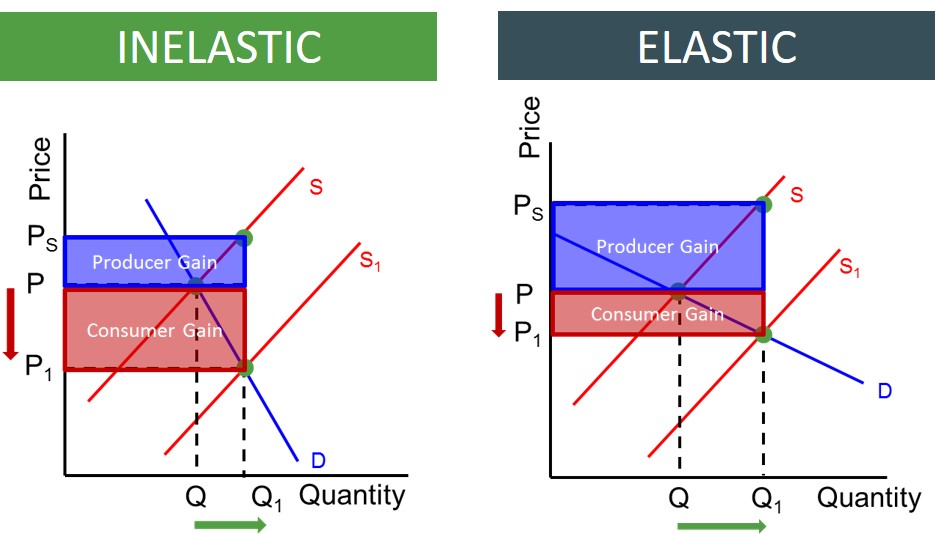

The degree of elasticity also affects who benefits from the imposition of a subsidy. The more inelastic the demand curve, the greater the benefit for consumers as a large percentage of the subsidy is passed onto consumers via a lower market price. However, when the demand curve is elastic, the smaller the price fall and the smaller the subsidy gain for consumers as a result of a smaller price fall. Conversely, producers take most of the subsidy benefit when the demand curve is elastic, as they keep hold of much of the cost savings from the subsidy. Below is a set of diagrams to show how the incidence of the subsidy (producer and consumer benefits) depends on the elasticity of demand.

Despite all of this, it is much harder in reality to grant an industry a subsidy, as governments do not know the precise size of the externality in the market. This is because externalities are difficult to value and therefore the governments attempts are just estimates of the value of the externality. These estimates are unlikely to be precisely accurate as some goods may exhibit different externalities when consumed or produced by different agents. All of this means making a decision about providing a subsidy or the size of a subsidy is difficult.