Changes to taxes, government spending and borrowing that aim to influence the level of economic activity in order for the government to achieve the main macroeconomic objectives.

The policy works by the government changing the level of taxation and government spending over a period of time and the fiscal stance that the government decides to take all depends on the state of the economy at the time. For instance, during a recession an economy is stimulated via higher spending/lower taxes in order to inject demand and economic activity into the economy. Whereas during a boom, spending is reduced/taxes raised to help control inflationary pressures that have arisen and also governments use this period to help pay back any past borrowings which fuelled previous budget deficits i.e. national debt.

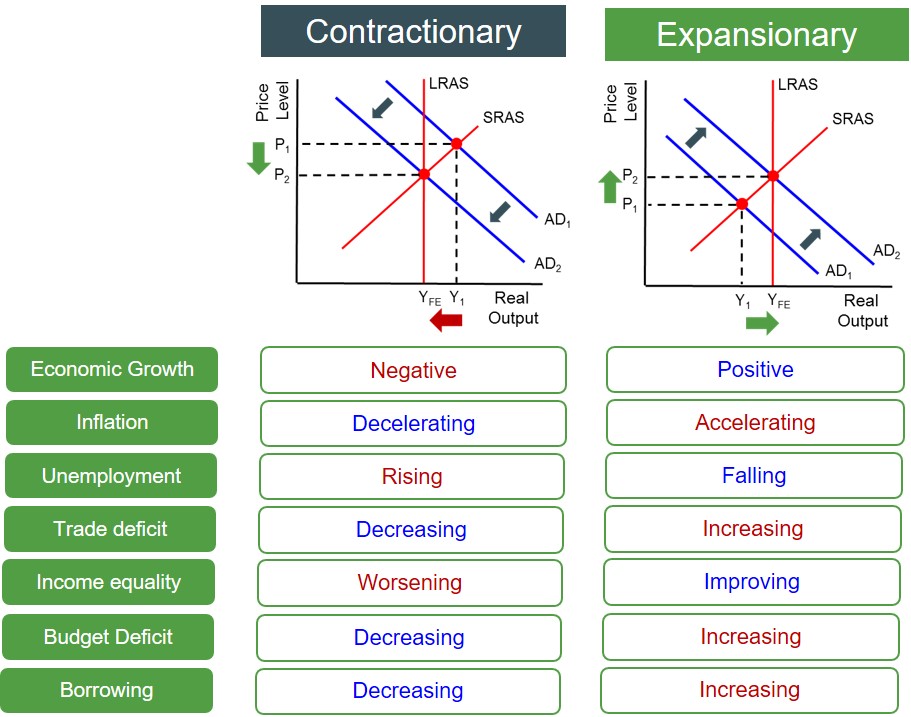

There are two different types of fiscal policy that the government can implement:

- Expansionary Fiscal Policy - stimulates aggregate demand (injections)

- Contractionary Fiscal Policy - restricts aggregate demand (leakages)

The impact of these policies on the main macroeconomic variables are shown below assuming ceteris paribus.

It is important to note that fiscal policies are often used alongside monetary policies, as fiscal policies should not be predominantly used to control prices as this is the role of monetary policy.

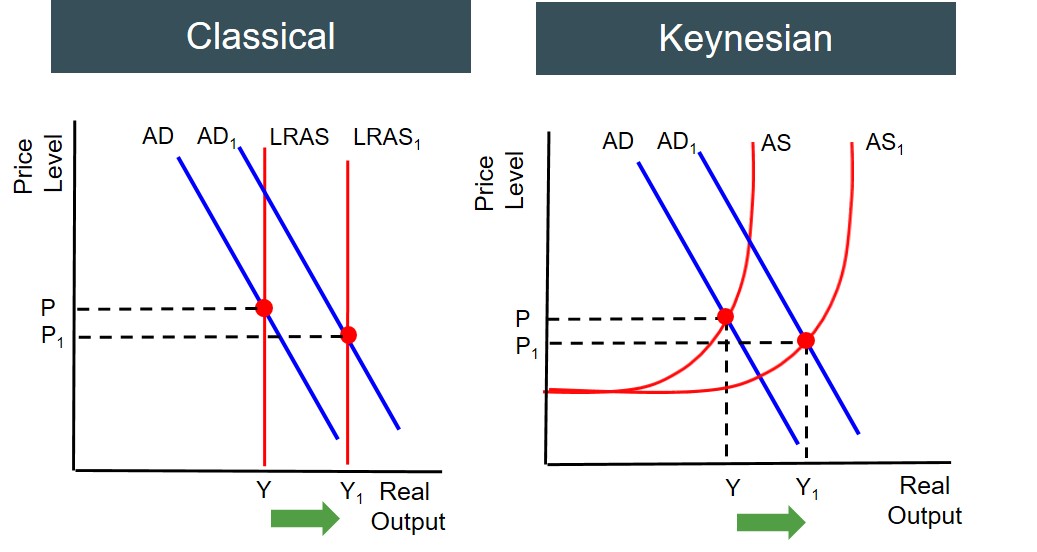

However, it is important to note that the long-run impact of a fiscal policy all depends on the sectors of the economy that the policy has targeted. For instance, if an expansionary fiscal policy is run, it predominantly increase spending by the government into the public sector. If that spending has been directed to areas of the economy with strong productivity links (e.g. education, health or transport) then productivity gains will be large and ultimately this will create an accompanying LRAS curve shift in the long run, creating dis-inflationary growth. However, if it is targeted to areas with tenuous links to productivity then it is unlikely to significantly change the position of the LRAS curve and the end result will just create inflationary pressures without growth.

From a policymakers perspective, the desired outcome of fiscal policies is to direct spending to those productive areas of the economy to instigate the LRAS shift. This desired outcome of dis-inflationary growth is shown below from both the Classical and Keynesian perspectives.

However, as with all economic policies it is not an exact science. This is the theoretical outcome of an expansionary fiscal policy on real output and the price level but the impact seen on the economy in reality may take a different form, as a result of a few factors.

Firstly, it is important to consider the impact of the multiplier effect on these shifts, as the larger the multiplier effect the greater the initial impact on AD. This is important for the government to consider because if the multiplier effects is large then perhaps they can increase spending by a smaller amount originally to get the desired AD curve shift. However, the size of the multiplier effect (positive or negative) can become diluted by the presence of automatic stabilisers, which can end up limiting the effectiveness of fiscal policies.

Secondly, if a government decides to increase spending then this can create resource and financial crowding out effects in the economy. This is because if the government increases spending into the public sector, this will ultimately lead to the public sector to expand. This could potentially be a problem if the economy is at full capacity because at full capacity the economy's resources are being fully utilised, so therefore to increase the size of the public sector, resources must be transferred from the private sector to the public sector, which subsequently shrinks the private sector. This is often interpreted as a problem because the private sector is profit maximising and is the sector of the economy that is the most efficient. This perhaps explains why expansionary fiscal policies are used only when the economy has spare capacity, so this crowding out effect does not happen.

Finally, when governments run budget deficits that have to fund that deficit by borrowing, but ultimately that debt has to be repaid back with interest. So it may well be that the AD curve shift is muted compared to theoretically anticipated. This is because if the government runs up a deficit via lower taxes, then this might not encourage consumers and businesses to spend and invest, if they anticipate that higher taxes will be introduced in the future to repay these debts off. It might well be the case that consumers save the tax break today in order to pay of future tax increases. It could be evaluated that this might not make much of a difference if the budget deficit is created by higher spending with a sizable multiplier effect.