An ongoing process that is improving the integration of the world’s economies to reduce the restrictions on where goods and services are made and sold. This allows large numbers of goods and services to be sold in many countries.

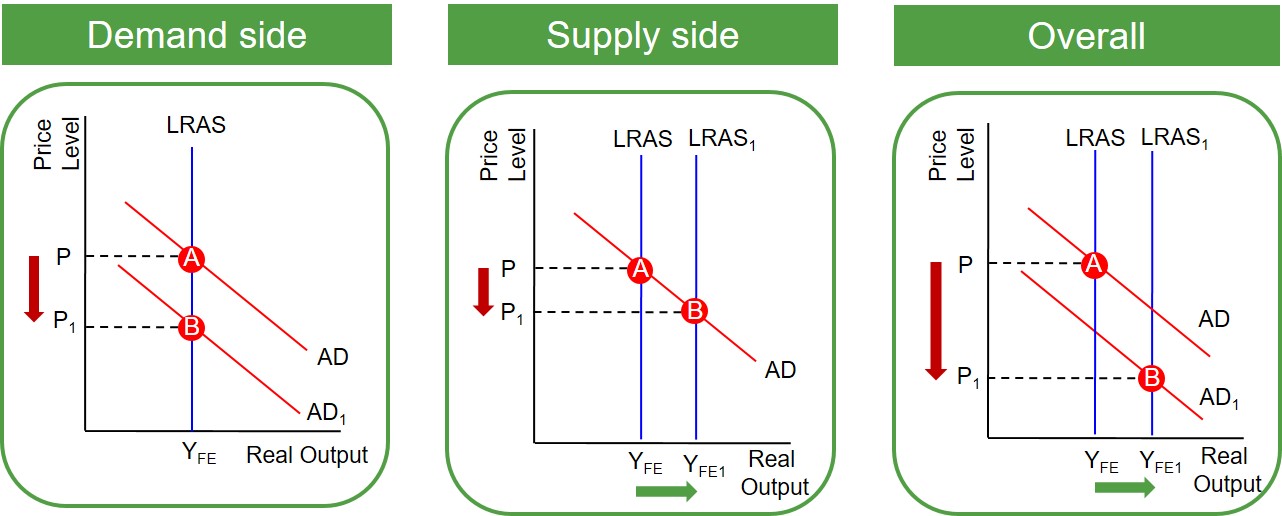

Below shows how globalisation has affected the UK economy in an AD-AS framework.

As the UK has run a trade deficit continuously since 2006 the globalisation impact on AD has been negative (indicated by AD at AD1 rather than at AD). This does not mean there has been no AD growth over that period it just means that the contribution from globalisation has been negative as the UK imports more than it exports. However, globalisation has allowed the UK economy to expand productive processes and capture economies of scale so that it has had a positive impact on the productive capacity of the UK economy (LRAS to LRAS1). Overall, the effect of globalisation is that the UK has expanded its productive capacity (YFE to YFE1) without inflationary effects (P to P1). This is an excellent example of how the expansion of productive capacity is critical to achieving sustainable economic growth.

Different countries will experience a different balance of demand and supply side effects. Students will need to explain the outcome of these using AD/AS analysis.