The distribution of income is a measure of the share of income that is distributed across the population of a country.

An unequal distribution of income is often a characteristic of modern day economies as a perfectly equitable distribution is impossible to achieve. This is because there is no economy in the world by which a perfectly equitable distribution of income can be achieved. This is because in the free market, workers always have the incentive to work harder by being rewarding with higher levels of pay and therefore it is this that drives the income inequality within a country. However, the degree and extent of income inequality varies between countries all on the basis on different levels of economic development, public service access, political and social structure as well as the cultural identity of a country.

In theory vast amounts of inequality are bad for a country as it negatively impacts individuals standard of living, by damaging their aspirations, opportunities and income. This is compounded by the fact that these individuals will have limited access to the crucial public services within a country such as sufficient levels of healthcare and further education. The economic consequences of this is that it can damage the level of human capital established across the economy, shrinking the quality and quantity of the factors of production and ultimately damaging the productive capacity of the economy, as well as the long-run trend growth rate of a country.

But despite all of these economic issues created by an unfair distribution of income, governments are never searching for a distribution of income that is perfectly equal as this is not always a sign of a growing and developing economy. This is because an unequal distribution of income could be a sign of economic prosperity that has possibly been brought about by entrepreneurial innovation. Governments therefore accept that a degree of inequality for a country is not always a particular weak feature of the economy as long as it is controlled and has been created via a productive and sustainable way.

Therefore a good evaluation point to consider is that if the incentive of being rewarded with higher incomes was no longer present in the labour market, then surely an economy would be worse-off despite the fact that theoretically the distribution of income would be fairer, because the positive benefits of individuals striving for a better standard of living will be lost. Therefore, it is up to the government to be able to identify whether a worsening in the distribution of income is a fair reflection of the effort and contribution that certain individuals have made to the economy over time.

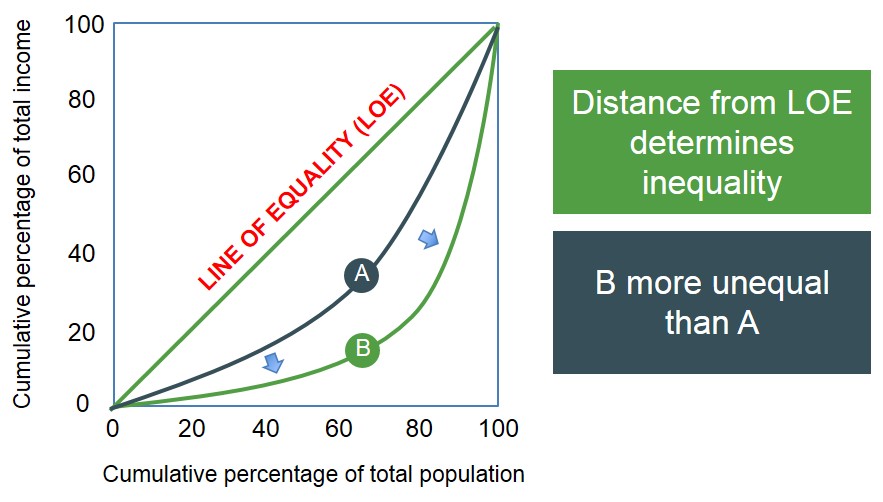

One of the most commonly used methods of measuring the income distribution for a country is to analyse the Lorenz Curve. Below is a diagram which illustrates the income distribution for a country worsening as the Lorenz Curve has shifted out to B. This means that a bigger fraction of income is held by a smaller percentage of people i.e. the very wealthy. Likewise it is the opposite for an inwards shift of the curve. From this measure the Gini Coefficient can be derived, placing the measure of the income inequality of a country into one single figure.

However, despite the measures being simple and intuitive to look at and analyse in theory, they do contain a significant amount of limitations which restrict the ability to accurately reflect the true picture of the distribution of income in a country. Some evaluation points you could mention are:

- Limitations behind cross-country comparisons i.e. cannot compare the inequality measures of a developed country in sub-saharan Africa with the inequality measure of a developed country in Europe.

- Limitations when drawing conclusions about the level of economic development in a country i.e. some countries like the US have high levels of income and development but also a reasonably high level of income inequality.

- Limitations of the use of inequality measures because of issues regarding data availability and reliability.

- Inequality measures are too narrow and often oversimplified and therefore may not provide a true reflection of the distribution of income within a country e.g. does not take into account age distribution or the current level of government policies.