A policy perspective that favours government intervention in order to correct any market failures present and in the process increase the level of economic welfare in society. Policymakers that take this perspective, believe that the only way a government can fulfill their macroeconomic objectives is for a heavy layer of government intervention to be administrated.

The type of interventionist policies include:

- Regulation

- Nationalisation

- Investment in human capital

- Investment in infrastructure

- Investment in technology

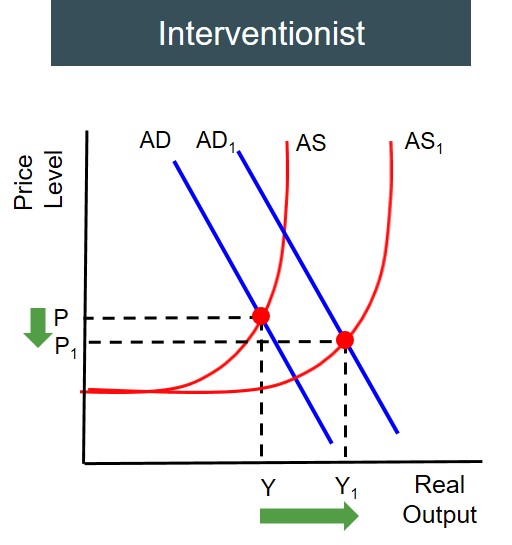

The aim is to shift the LRAS curve to the right as shown by the diagram below:

Apart from reducing the price level and increasing real output, interventionist policies create a number of different advantages for an economy:

- Greater equality - redistributes income and wealth to improve equality of opportunities.

- Corrects market failure - governments can ensure that markets do take into account of the externalities involved in the consumption/production of goods and services.

- Heals economic cycle problems - intervention helps overcome downturns in the economy.

- Increases economic efficiency and productivity - increases productive capacity of the economy.

However, these types of policies can also create problems in an economy and these are the evaluative points you should consider when talking about government intervention:

- Government failure - without full information can be pressurised by certain political groups to pursue inefficient projects.

- Loss of efficiency savings - nationalisation creates more state owned industries which lack profit making incentives and this could fail to drive up efficiency and lower costs.

- Restricts freedom - government intervention takes away the decision making process from private individuals which goes against the free marketeer view (the market is best at deciding what and how to produce goods and services).