Issued by the government to authorise producers to produce a specified amount of pollution. Provided the system can be policed effectively it can correct market failure by limiting pollution and the output associated with it.

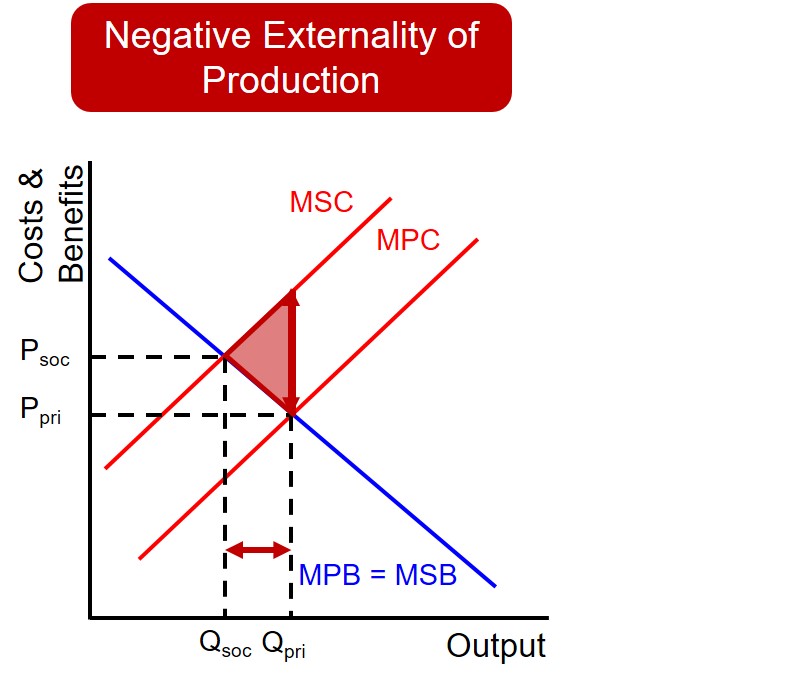

It is important for the government to control pollution as pollution is an example of a negative production externality which gets released onto society and as a result exposes society to a large social cost. Pollution is produced as a result of manufacturers failing to recognise the wider cost to society of this pollution being created during the production of goods and services. Therefore to protect social welfare and to remove the dead weight loss triangle associated with these goods, governments are committed to meeting pollution reduction targets. They hope that by placing these pollution targets on society it will incentivise private businesses to adapt their production process, in order to reduce pollution levels.

Pollution permits are issued and released into the market via the government and the key characteristic surrounding these permits, is that the fact that they are tradable i.e. pollution permits can be bought and sold between firms. The permits themselves grant an individual firm the legal right to produce a fixed level of pollution. The permits are enforced via financial punishments to ensure that firms stick to the pollution permit limits. But crucially, any firm that produces below their emissions limit can then sell the rest of the permitted emission allocation to other firms who have exceeded their pollution limit. This works because their are some firms that make use of materials throughout the production process that produce vast amounts of pollution and to keep the business going they must continue to pollute. This effectively means the firms that pollute the most, must acquire the greatest amount of pollution permits. Therefore, it is these firms that have to face the greatest burden of the permits, as they increase the firms costs, reducing their profitability and making them less competitive.

The desired outcome of the policy is that after a period of time firms will have transformed their production process into a more emission friendly process (via green technology) so that they can reduce the amount of pollution permits they are required to buy and hold. Eventually, if all firms can successfully implement a more environmentally friendly approach to their production process, then the government can gradually decrease the number of permits circulating in the market.

In 1997, an agreement called the Kyoto Treaty was signed to enforce tradable pollution permits across countries. In this instance, each country was awarded a pollution permit to limit their carbon dioxide emissions. The countries which were able to reduce their emissions cheaply were incentivised to do so. This meant they could sell the rest of their quota off to countries which required more pollution permits.

It is also important to consider the limits of the pollution permits effectiveness in reducing the overall level of pollution. These will be good evaluation points to make in an exam.

Firstly, it is very difficult for the government to identify the optimal quantity of permits to issue in the market and the most appropriate way to distribute them in the first place. Introducing too many permits into the market will lead to pollution levels staying at the same level. Not issuing enough permits will have the opposite effect and firms will become unnecessarily constrained and this can reduce the activity, efficiency and productivity of these firms.

Also, as pollution is a negative externality it makes it very difficult to measure and quantify and therefore this makes it difficult for the government to set the right pollution limit per permit.

Pollution permits are also criticised because they do not actually address the issue of pollution and instead create a system in which the least polluting firms receive the smallest amount of permits, whilst the most polluting firms receive a large percentage of the permits. Therefore, they can fail to make a substantial impact on the pollution levels of firms and a country. Alternative policies such as indirect taxation may prove more effective in curbing pollution levels in a country as this allows the externality to be internalised. These alternative policies might also be easier to implement, as it does not require significant monitoring like in the case of permits. The administration costs may well be lower as well.