The amount by which the imposition of an indirect tax will reduce producer surplus. The tax burden imposed on producers will depend crucially on the elasticity of the demand curve facing the market. As the less price sensitive consumers are the more of the tax that can be passed onto them in the form of higher prices as it will increase their level of profit despite price rises due to a lack of drop-off in demand.

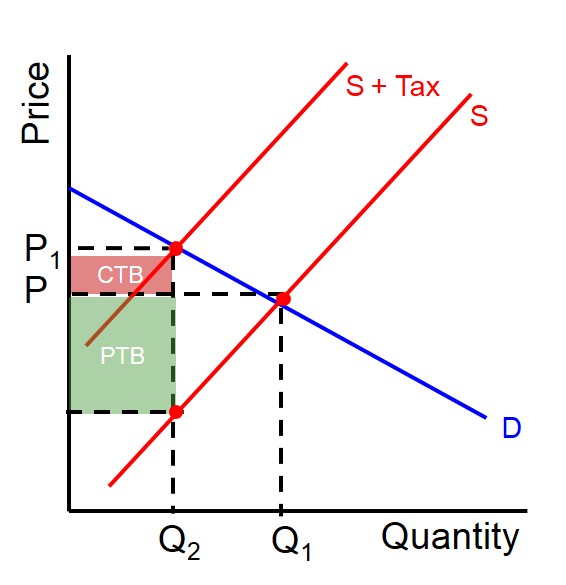

Below is a diagram to illustrate how the imposition of an indirect tax implaces a burden on producers. In this instance the demand curve is neither inelastic or elastic and therefore the tax burden is split evenly between the consumers and producers.

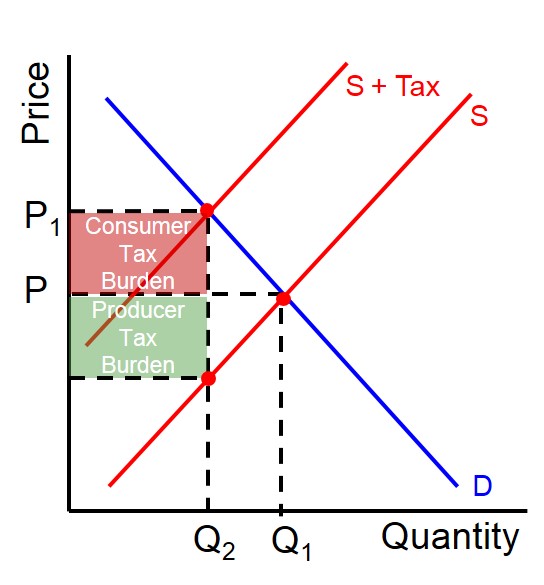

Below is a diagram to illustrate when the demand curve is inelastic and therefore the tax burden is split unevenly towards consumers ahead of producers.

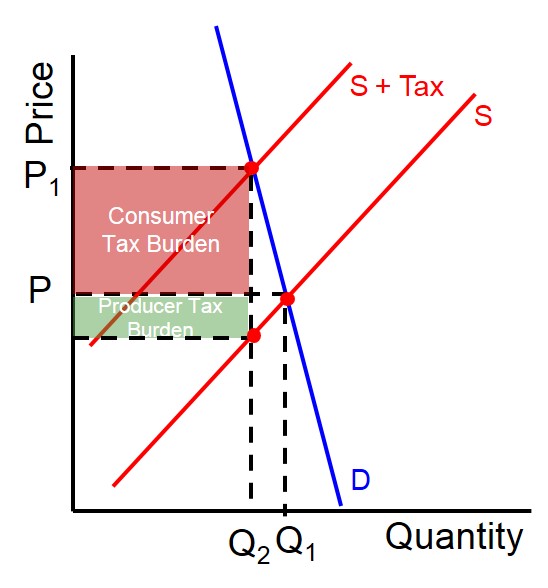

Below is a diagram to illustrate when the demand curve is elastic and therefore the tax burden on producers is small.