Is the debt that is owned by the government of a country. A high level of public sector debt can be argued to be positive and negtaive for the economy depending on the person's inclined way of thinking. It can increase economic growh by fostering more investment in infrastructure or it can decreae economic growth via crowding-out effects.

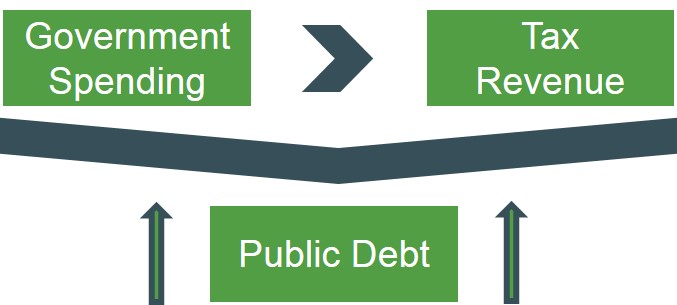

Below is a graphic to show that if the government runs up a significant budget deficit then it accumlates the level of public national debt for a country. This is why government's are under pressure to not consistently run a budget deficit, so that the burden of debt can be be shaved off. As the more indebted a country becomes the lower their creditworthiness is i.e. credit rating deterioriates.