When people form their inflation expectations by using all the available information at their disposal.

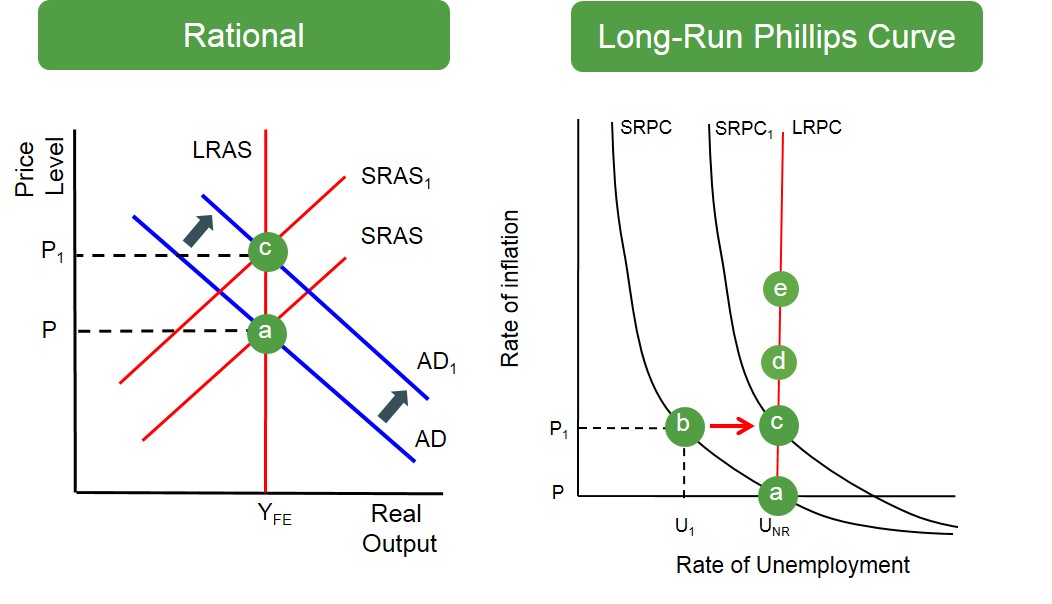

Below is an illustration of rational expectations in a supply and demand framework and its effects on the economy. As individuals are using all of the information at their disposal to form their inflation expectations if they see an expansion in the aggregate demand curve creating inflationary pressures, automatically they will negotiate higher wage demands so that real wages are unaffected and therefore the shift of the AD and SRAS curve happen automatically and if agents have these forms of expectations then it is just a continual movement up the LRAS curve from a to c.

In terms of the phillips curve it just shifts up the short-run phillips curve at the natural rate of unemployment creating a new long-run phillips curve as shown below.